fsa health care limit 2022

10 2021 the IRS released Revenue Procedure 2021-45 Rev. 21-45 which announced that the health FSA dollar limit on employee salary reduction contributions.

Healthcare Fsa Vs Hsa Understanding The Differences Forbes Advisor

So if you had 1000 in your account at the end of this year you could carry it all over into 2022.

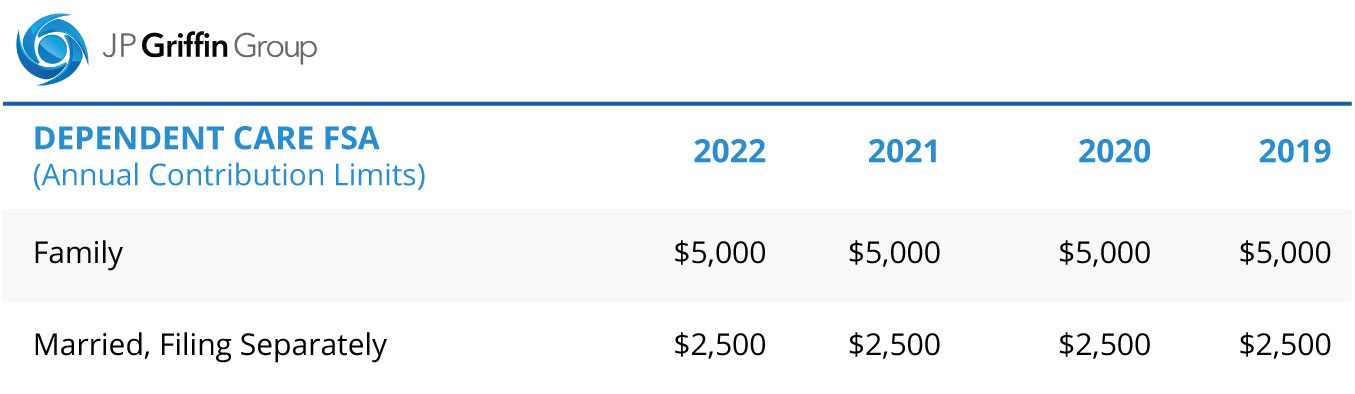

. The annual contribution limit for your health care flexible spending accounts health FSAs is on the rise for 2022 according to the Society for Human Resource Management. The Dependent Care FSA. Posted November 26th 2014 in Individuals.

Health FSA Carryover Maximum. President pro Tempore of the Senate. Heres an example eligible expenses that someone with a Health Care Flexible Spending Account FSA.

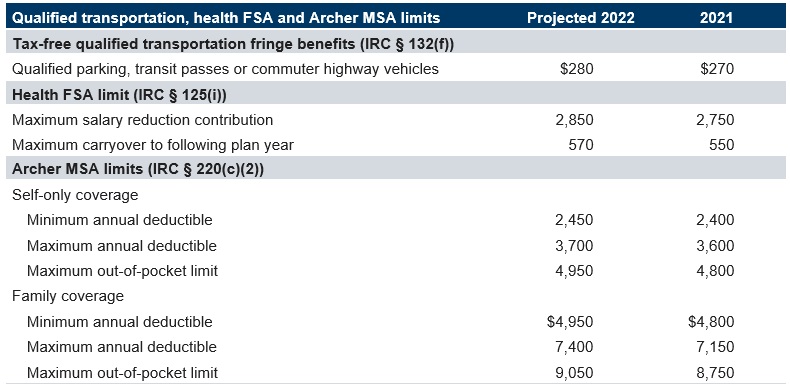

In 2021 the pre-tax contribution limit is 2750 and in 2022 the limit is 2850 but an employer can choose to set a lower limit. The annual maximum 2022 FSA contribution limit will increase to 2850. On November 10 2021 the Internal Revenue Service IRS announced that the health flexible spending account FSA dollar limit on pre-tax salary reduction contributions will.

Per Employee Limit. Speaker of the Assembly. For 2022 you can contribute up to 2850 in your health FSA.

The health FSA limit applies on an employee-by-employee basis. The limits increased 100 from last year. A health FSA can be used for.

Your full LPHC FSA election amount also known as your Annual Goal is available to you on the effective date of your enrollment which is. The Affordable Care Act ACA imposes a dollar limit on employees salary reduction contributions to health flexible spending accounts FSAs offered under cafeteria plans. It also includes annual inflation-adjusted numbers for 2022 for a number of other tax provisions.

The usual carry-over limit is 550 You can also contribute up to the maximum. 2022 FSA Contribution Limits. Health Care FSA contribution limit - 2850.

The annual limit applies to Health FSAs. Skip to main content. And if an employers plan allows for carrying over unused health care.

You contribute funds to an HSA and FSA but only your employer can contribute to your HRA. Both an employer and employee can contribute to an FSA. When are LPHC FSA funds available.

Under the CAA employers are allowed but not required to permit the following for either or. The 2022 FSA carryover is 570 per year which is up 20 from 2021. The IRS has released Revenue Procedure 2021-45 confirming that for plan years beginning on or after January 1 2022 the health FSA salary.

CY2022 Limited Purpose Health Care FSA FAQs. Each employee may only elect up to 2850 in salary reductions in 2022 regardless of whether. In November the IRS updated the annual contribution limits for FSAs.

Compliance November 10th 2021. FSAs only have one limit for individual and family health plan. Your employer may set a lower limit.

Dependent Care Assistance Plans Dependent Care FSA annual maximum unless. They will need to obtain an Explanation of Benefits. This is an increase of 100 from the 2021 contribution limits.

The Governor of California. The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021. Health Care FSA Limits Increase for 2022 Employees can deposit an incremental 100 into their health care FSAs in 2022.

21-45 also increases the carryover limit for a health FSA to 570. The limit on annual employee contributions that can be carried over to the next year was raised in 2022. WageWorks that the deductible limit was met.

For 2022 participants may contribute up to an annual maximum of 2850 for a HCFSA or LEX HCFSA. Each year the IRS allows you to put a maximum amount of money into.

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Year End Health Care Fsa Reminders Hub

Flexible Spending Accounts Department Of Administrative Services

Fsa Eligible Items And Expenses Of 2022 Best Ways To Use Your Fsa Dollars Cnn Underscored

2022 Transportation Health Fsa And Archer Msa Limits Projected Mercer

2021 Year Planner Hra Consulting Photo Yearly Planner Planner Calendar Template

Health Care Consumerism Hsas And Hras

Health Spending Account Hsa Coverage List Of Eligible Expenses Groupenroll Ca

Your Guide To The Best And Most Affordable Health Insurance Plans Forbes Advisor

Healthcare Spending Account In Ontario The Benefits Trust

Health Spending Account Hsa Coverage List Of Eligible Expenses Groupenroll Ca

Coronavirus Surprise Irs Allows Midyear Insurance And Fsa Changes Fierce Healthcare

What Is A Health Care Spending Account In Canada

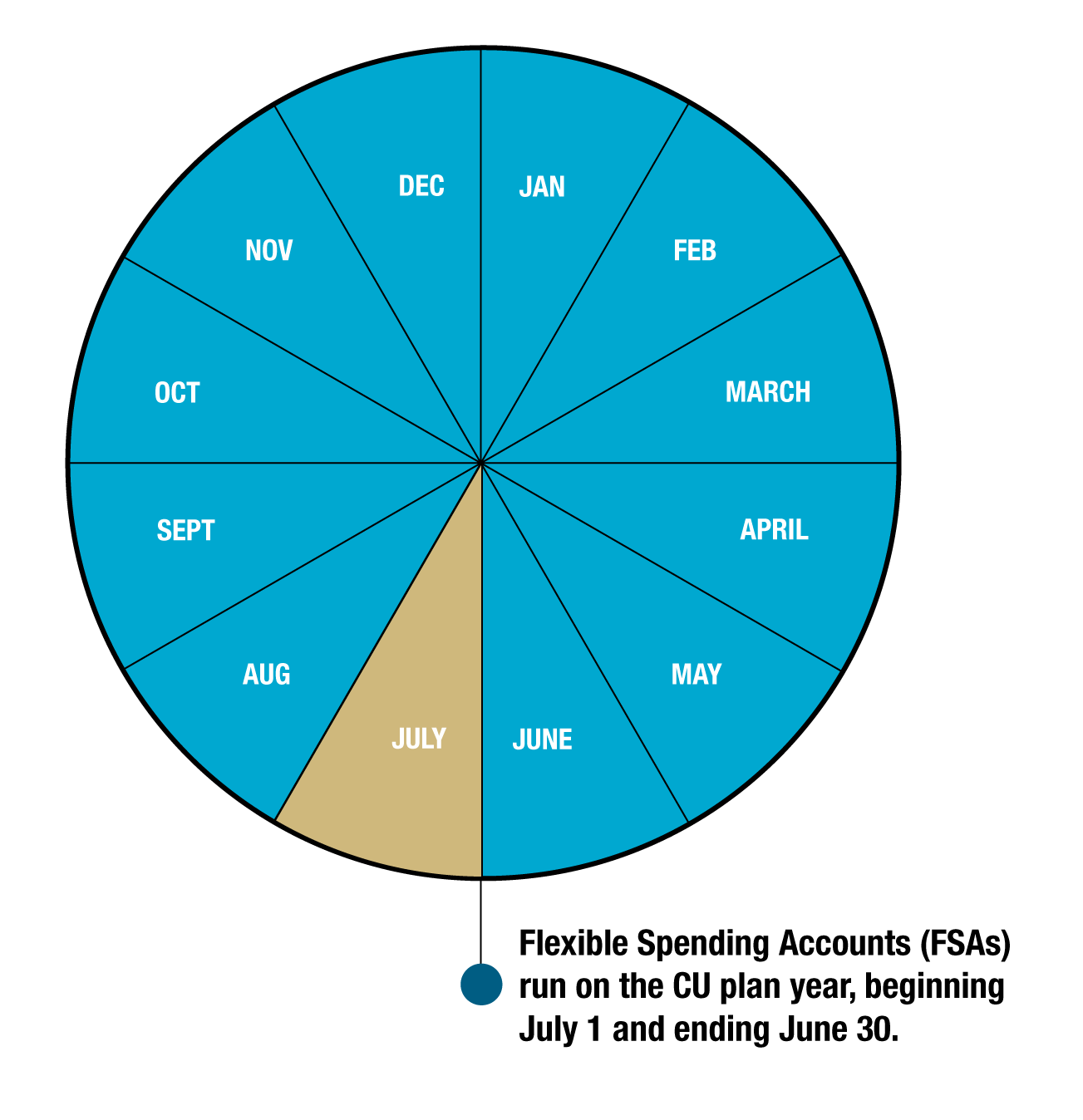

Health Care Fsa University Of Colorado

Flexible Spending Account Contribution Limits For 2022 Goodrx

Hra Vs Fsa See The Benefits Of Each Wex Inc

Insurance Abbreviations And Acronyms Made Easy

Flexible Spending Account Vs Health Savings Account Which Is Better